-

blog

2019

- Florida HO Rate Filing... What, Why, When & How?

- AUTHOR: Achille Sime

Coral Gables, October 11, 2019 – SL FINANCIAL is an actuarial consulting and advisory firm based in Miami, Florida. We offer complete actuarial solutions in both traditional (re)insurance and alternative risk financing industries.

Ratemaking is the process of establishing rates used in insurance or other risk transfer mechanism. The Statement of Principles Ratemaking sets out four principles for ratemaking:

- Principle 1: a rate is an estimate of the expected value of future costs

- Principle 2: a rate provides for all costs associated with the transfer of risk

- Principle 3: a rate provides for the costs associated with an individual risk transfer

- Principle 4: a rate is reasonable and not excessive, inadequate, or unfairly discriminatory if it is an actuarily sound estimate of the expected value of all future costs associated with an individual risk transfer

The process is key to General Insurance (GI) or property and casualty (P/C) profitability and as such is covered in typical objectives of insurance regulation:

- Maintain insurer solvency

- Protect insurance consumers

- Ensure availability of coverage; and

- Regulate insurance rates

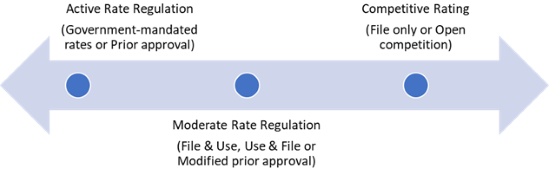

Rate regulation has a role in addressing all the objectives of insurance regulation and there is a wide range of rate regulation systems, which includes government-mandated rates at one extreme and open competition at the other (see illustration below):

Most rate regulation system allow private insurers to determine their own rates but require justification of these rates to the regulator, who must approve them, based on projections of claims and expenses. Insurers submit projections and forecasts (typically compiled in a rate filing) that are based on historical experience with adjustments, as required, for trend, development, product reforms, law change, etc.

Over the past three years, SL FINANCIAL managed to increase presence in Florida, assisting small and medium size private insurers along with regulator in areas of rate filing, actuarial reserve certification, reinsurance pricing and catastrophe modeling. So, what makes a good Florida Homeowners rate filing?

- Know and Follow Instructions – key Florida Statutes include:

- 627.062 Rate Standards includes the type of filing (e.g. File & Use or Use & File), actuarial documentation showing that rate is not excessive, inadequate or unfairly discriminatory; with consideration given to general accepted and reasonable actuarial techniques, reasonableness of judgment, cost of reinsurance or certification under oath by the CEO/CFO and the Actuary

- 627.0645 Annual Filings includes annual requirements

- Key rules from Florida Administrative Code (e.g. 69O-170.0135 Actuarial Memorandum)

- Consider Filing Presentation – Understand the review process and help the user to navigate

- Learn from Others – Review recent approved filings and stay informed on current topics

SL FINANCIAL developed a unique methodology that aims at simplifying the rate filing process for both the insurer and the regulator i.e. the Florida Office of Insurance Regulation (FLOIR). In particular that process include our Florida Rate Filing Document Mapping tool, that ensure the following part of the filing are submitted appropriately:

- Cover Letter

- Manual Page Checklist

- Revised Manual Pages

- Consultant Authorization Letter

- Catastrophe Modeling Support and Inputs/Outputs

- Reinsurance Program Support

- Territorial Rates Support

- FLOIR Mandatory Forms:

- Rate Collection System (RCS)

- Rate Level Exhibits, or

- Rate Indication Workbook

For any question or media inquiry, please visit our website at www.sl-financial.com or contact our team at that ceo@sl-financial.com.

MEDIA CONTACT

Achille Sime

CEO

2525 Ponce De Leon Blvd, Suite 300

Coral Gables, FL 33146

- Achille Sime

Principal/CEO

Fellow of the Institut des Actuaires France (FIAF)

Fellow of the Society of Actuaries (FSA)

Member of the American Academy of Actuaries (MAAA)

Chartered Enterprise Risk Analyst (CERA)

Affiliate of the Casualty Actuarial Society (AFFI CAS)

- bio