-

blog

2019

- U.S. P/C Appointed Actuaries - 2019 Changes

- AUTHOR: Achille Sime

Coral Gables, October 10, 2019 – SL FINANCIAL is an actuarial consulting and advisory firm based in Miami, Florida. We offer complete actuarial solutions in both traditional (re)insurance and alternative risk financing industries.

Historically, U.S. property and casualty (P/C) actuarial education was provided by the Casualty Actuarial Society (CAS), while all other educational tracks or specialties were covered by the Society of Actuaries (SOA). As such, the National Association of Insurance Commissioners (NAIC) definition of a qualified actuary eligible to be an Appointed Actuary included only membership of the CAS as core requirement.

Following the introduction of a General Insurance (GI—aka P/C) track in October 2011, the SOA asked the NAIC to also include a Fellow of the Society of Actuaries (FSA) who had successfully completed the SOA’s GI track. A summary of the the process of reviewing the SOA’s GI track is presented below:

- 2015 – SOA requested that NAIC determines whether its GI track can be included in NAIC definition of a qualified actuary and NAIC opted to conduct an independent review by hiring a consultant to conduct such a review and assigning an Executive (EX) Ad Hoc Group of commissioners to oversee the project.

- 2017 – NAIC released the results of the consultant’s work. The SOA’s GI track was found to lack the necessary breadth and depth to meet the minimum educational standards, while the CAS membership was found acceptable, with some question about the associateship level.

- 2017 – NAIC hired a consultant to conduct a P/C Appointed Actuary Job Analysis aiming at re-defining a Qualified Actuary based on objective criteria. NAIC then worked with the CAS, SOA and the American Academy of Actuaries (Academy) to complete the Job Analysis, draft educational standards, conduct assessments of the CAS and SOA syllabi, and expose/implement revised actuarial opinion instructions.

- 2018-2019 – NAIC P/C Appointed Actuary Job Analysis and NAIC P/C Educational Standards and Assessment projects were completed by NAIC assisted by numerous subject matter experts (SME) nominated by the CAS, SOA and Academy. These projects resulted in documentation of knowledge statements (i.e. what an Appointed Actuary needs to know for the P/C Appointed Actuary job) and elements of each knowledge statement that should be included in basic education as a minimum educational standard, with the remaining elements achievable through experience or continuing education.

- 2019 – CAS and SOA have made or agreed to make minor changes to their syllabi and reading materials to meet these minimum standards; with effective date Jan. 1, 2021.

- 2019 – NAIC finalized the assessment of CAS and SOA, with following designations and exam requirements being NAIC Accepted Actuarial Designation:

- Fellow of the CAS (FCAS) with successful completion of Exam 6-US

- Associate of the CAS (ACAS) with successful completion of Exam 6-US and Exam 7

- FSA with successful completion of the GI track, including Financial and Regulatory Environment (FRE)-US Exam and Advanced Topics in GI (ADV) Exam

- 2019 – NAIC also proposed exams substitution table and/or recommendation for actuaries that achieved qualification under the 2018 and prior definition of qualified actuary.

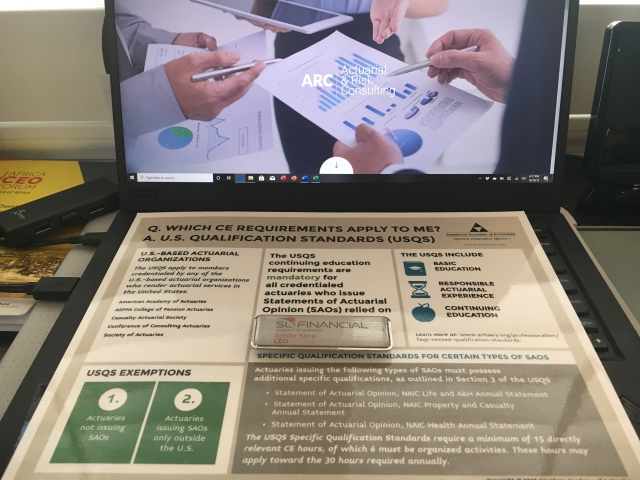

As per the approved 2019 NAIC P/C Annual Statement Instructions, an Appointed Actuary is a Qualified Actuary (or individual otherwise approved by the domiciliary commissioner) appointed by the Board of Directors in accordance with Section 1 of the instructions. “Qualified Actuary” is a person who:

- meets the basic education, experience and continuing education requirements of the Specific Qualification Standard for Statements of Actuarial Opinion, NAIC Property and Casualty Annual Statement, as set forth in the Qualification Standards for Actuaries Issuing Statements of Actuarial Opinion in the United States (U.S. Qualification Standards), promulgated by the American Academy of Actuaries (Academy), and

- has obtained and maintains an Accepted Actuarial Designation; and

- is a member of a professional actuarial association that requires adherence to the same Code of Professional Conduct promulgated by the Academy, requires adherence to the U.S. Qualification Standards, and participates in the Actuarial Board for Counseling and Discipline when its members are practicing in the U.S.

An exception to parts (i) and (ii) of this definition would be an actuary evaluated by the Academy’s Casualty Practice Council and determined to be a Qualified Actuary for particular lines of business and business activities.

SL FINANCIAL played a prominent role assisting the NAIC completing these projects:

- SMEs in NAIC P/C Appointed Actuary Job Analysis Project

- SMEs in NAIC P/C Educational Standards and Assessment Project

- Provided feedback to NAIC exposure drafts

- Our CEO has over 16 years of experience in reinsurance and consulting. Upon completing designation as Fellow of the Institut des Actuaires of France (FIAF) and moving to the U.S., he was evaluated by the Academy’s Casualty Practice Council and determined to be a Qualified Actuary. Being determined to further demonstrate qualification via examinations, he became in 2015 the first FSA to complete the SOA’s GI track.

Over the past three years, SL FINANCIAL managed to increase presence in Florida, Africa and the Caribbean. Our key expertise includes: Appointed Actuary, Rate Filing, Reinsurance Pricing and Catastrophe Modeling.

MEDIA CONTACT

Achille Sime

CEO

2525 Ponce De Leon Blvd, Suite 300

Coral Gables, FL 33146

- Achille Sime

Principal/CEO

Fellow of the Institut des Actuaires France (FIAF)

Fellow of the Society of Actuaries (FSA)

Member of the American Academy of Actuaries (MAAA)

Chartered Enterprise Risk Analyst (CERA)

Affiliate of the Casualty Actuarial Society (AFFI CAS)

- bio