-

blog

2020

- ART Case Studies

- AUTHOR: Achille Sime

Coral Gables, September 7, 2020 – SL FINANCIAL is an actuarial consulting and advisory firm based in Miami, Florida. We offer complete actuarial solutions in both traditional (re)insurance and alternative risk financing industries.

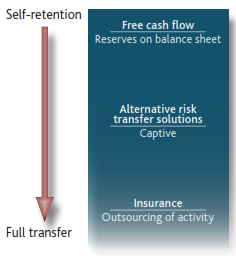

The alternative risk transfer (ART) market is a portion of the insurance market that allows companies to purchase coverage and transfer risk without having to use traditional commercial insurance. The ART market includes self-insurance, risk retention groups (RRGs), insurance pools, and captive insurers, wholly-owned subsidiary companies that provide risk mitigation to its parent company or a group of related companies:

- Self-insurance is when a company or individual sets aside its own money to pay for a possible loss rather than purchasing insurance with another company to reimburse them for any loss.

- RRG and captive insurance tends to be more popular with large corporations. Pools are more commonly used by businesses that face the same risk as it allows them to pool resources to provide insurance coverage. Pools are also often associated with groups of governmental entities that band together to cover specific risks.

- Alternative Products includes products such as contingent capital, derivatives, and insurance-linked securities (ILS). ILS refers to transactions in which insurance risks are transformed into transparent and/or tradable capital market products. They involve issuing a bond, which proceeds are invested to increase the amount of funds available to cover liabilities while bondholders receive interest.

There are many reasons for a company or a group to resort to ART:

- Solution to market inadequacies

- Reduction or stability of insurance premiums at group level

- Retention of the profits of good risk management

- Optimization of financial flows linked to risk management

- Direct access to global professional reinsurers

- Better risk management

SL FINANCIAL helps alternative market risk owners, captive managers and service providers determine risk retentions that optimize the balance between the cost of risk transfer and loss volatility.

Case Study #1 – Florida Truckers Risk Retention Group

Despite favorable driving conditions and loss experience, the commercial market for Florida-based trucking operators is limited. As a result, well run and profitable operations are not able to benefit from profits of good risk management. Based on these factors, a select group of operators have determined that the formation of a RRG is a viable strategy for the Automobile Liability insurance program for its member insured. SL FINANCIAL was hired to work alongside the retained RRG manager, program underwriter and reinsurance intermediary to perform an actuarial feasibility study and 5-year financial proforma for the RRG license application with the selected state regulator.

Case Study #2 – Florida Insurer Catastrophe Bond

Due to limited capacity for catastrophe excess of loss reinsurance, a Florida-based insurer has decided to sponsor a catastrophe bond in order to benefit from the favorable pricing compared to traditional reinsurance. SL FINANCIAL was hired to perform an actuarial feasibility study during the formation and to serve as loss reserve specialist after the formation of the bond.

Case Study #3 – Reinsurance Optimization for Emerging Market Insurance Group

Leading insurance group in emerging market has historically transferred a significant portion favorable technical results to global reinsurers. As a result of its improved risk profile and financial strength rating, the company had decided to optimize its reinsurance program. SL FINANCIAL was hired to perform actuarial analyses in support to reinsurance program optimization.

For any question or media inquiry, please visit our website at www.sl-financial.com or contact our team at that ceo@sl-financial.com.

MEDIA CONTACT

Achille Sime

CEO

2525 Ponce De Leon Blvd, Suite 300

Coral Gables, FL 33146

- Achille Sime

Principal/CEO

Fellow of the Institut des Actuaires France (FIAF)

Fellow of the Society of Actuaries (FSA)

Member of the American Academy of Actuaries (MAAA)

Chartered Enterprise Risk Analyst (CERA)

Affiliate of the Casualty Actuarial Society (AFFI CAS)

- bio