-

blog

2020

- COVID-19 Insurance Perspective

- AUTHOR: Achille Sime

Coral Gables, April 3, 2020 – SL FINANCIAL is an actuarial consulting and advisory firm based in Miami, Florida. We offer complete actuarial solutions in both traditional (re)insurance and alternative risk financing industries.

The world is going through an extraordinary event. Since it first appeared in Wuhan, China, in late 2019, the coronavirus (Covid-19) has spread rapidly to most of the world’s population. In order to buy time until a treatment is found, government need to partner with the private sector and development institutions in order to avoid the overflow of the healthcare systems, therefore safeguarding economies and livelihoods.

Given its unique role in driving economic growth, insurance would likely play a significant role in the response to Covid-19. This article will discuss possible challenges faced by different lines of insurance:

- Health. Possible increase of healthcare cost and utilization given the relative high cost associated with the protection, testing and treatment of the disease. Furthermore, there is also a possible increased in severity of claims related to illness that can be considered elective during the current crisis as their treatment are delayed until after the Covid-19 epidemic.

- Life. Possible increase of short-term mortality and surrender benefit to be paid by insurers.

- Pension. Possible reduction of contributions coupled with significant reinvestment risk given the material decrease in interest rates.

- General Insurance. Possible increase in workers compensation claims for essential workers and remote workers for which the employer has virtually no control. Possible increase in Covid-19 related general liability, business interruption and event cancellation claims. Finally, global exposure to cyber liability is likely to increase as one of the most effective Covid-19 measure to-date involves a significant percentage of the workforce working remotely.

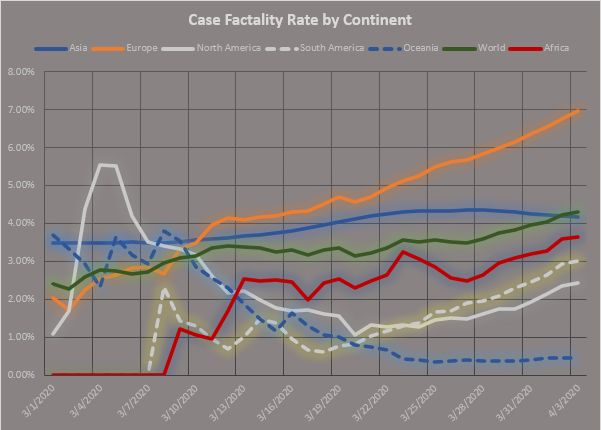

Statistics compiled to-date from data.humdata.org, indicates over 1 million confirmed cases around the world with a Case Fatality Rate (CFR) of 4.29%.

Full report is available for download: COVID-19 Insurance Perspective.

For any question or media inquiry, please visit our website at www.sl-financial.com or contact our team at that ceo@sl-financial.com.

MEDIA CONTACT

Achille Sime

CEO

2525 Ponce De Leon Blvd, Suite 300

Coral Gables, FL 33146

- Achille Sime

Principal/CEO

Fellow of the Institut des Actuaires France (FIAF)

Fellow of the Society of Actuaries (FSA)

Member of the American Academy of Actuaries (MAAA)

Chartered Enterprise Risk Analyst (CERA)

Affiliate of the Casualty Actuarial Society (AFFI CAS)

- bio